Nude Solutions

Nude Solutions has three Software as a Service Product offerings. Nude Solutions for Insurance brokers (BNude); Nude Solutions for Insurance Companies (CNude) and a host of Integration components which make up the Property and Casualty Insurance eco Eco-system.

The resources at The Art of Integration were an integral part of the Nude solutions development. Knowledge of CNude, BNude, the integration components and the Insurance business are all essential in providing integration services. The output from this work is an integrated business solution for the Insurance customer. A business solution that provides a competitive advantage for the Insurance Companies, Brokers and Agents that use it.

Some of the components in that Eco-system are outlined below:

The resources at The Art of Integration were an integral part of the Nude solutions development. Knowledge of CNude, BNude, the integration components and the Insurance business are all essential in providing integration services. The output from this work is an integrated business solution for the Insurance customer. A business solution that provides a competitive advantage for the Insurance Companies, Brokers and Agents that use it.

Some of the components in that Eco-system are outlined below:

Integration with a General Ledger System

The Art of Integration team has access to considerable levels of experience with several of the most predominant General Ledger systems. This includes, but is not limited to:

- Oracle Financials

- Dynamics Business Central (Microsoft's DBC)

- QuickBooks Online

- Several Custom Built General Ledger Systems (eg. TAM and EPIC from Applied Systems)

- Nude Solutions comes with a sophisticated Property and Causality specific Accounts Receivable and Accounts Payable sub-ledger systems. Each of the Commercially available Accounting packages also have sub-ledger systems. There is a place for both operating in a fully integrated way with no duplication of services. The critical success factor in the sub-ledger systems is a clear and traceable audit trail from the totals within the General Ledger to the detail transactions in the sub-ledgers.

Payments

Receiving Payments (Incoming) or making Payments (Outgoing) usually involves multiple third party interfaces to connect to. At the Art of Integration we avoid duplication of services and provide precisely the interfaces you need and avoid the duplication of interfaces you do not need.

The Integration of Payments becomes exponentially simpler when a couple of business rules are enforced within the integration software. Those two rules are: Never receive money without first having an outstanding Accounts Receivable transaction; never payout money without first creating an outstanding Accounts Payable transaction. These two rules will ensure all money is accounted for and we have the desired clear and traceable audit trail.

The Integration of Payments becomes exponentially simpler when a couple of business rules are enforced within the integration software. Those two rules are: Never receive money without first having an outstanding Accounts Receivable transaction; never payout money without first creating an outstanding Accounts Payable transaction. These two rules will ensure all money is accounted for and we have the desired clear and traceable audit trail.

Reporting

Nude solutions comes with a full set of standard Insurance Reports. The Art-of-Integration team can develop additional customized reports or provide training on the use of reporting tools such a Microsoft's Business Intelligence or Snow Flakes proprietary reporting environment. A part of the conversion process is to take the data from historical reports within the legacy system and carry them forward into the Data Warehouse. This allows reporting to include seamless reports that include data that was reported on in the Legacy system. (eg. a Seven Year Loss History Report run two years after conversion would include all seven years worth of data.)

Claims Vendor Integration

Claims can be paid directly to the Claimant or to a restoration Company that restores the Property to its original condition. Full Financial integration with these Companies saves time and costs for the Insurance Company and for the Vendor.

Co-existence with the Legacy System

The value of having micro-services and an overall enterprise architectures is the ability to use some of the components of the new system with some smartly designed interfaces to functionality within the Legacy system.

There are Pros and Cons to a "big bang" conversion versus a longer term one line-of-business at a time migration. If the one line-of-business at a time migration option is chosen, then co-existence requires several integration points between the Products on the new system versus those still on the Legacy system. A co-existence strategy can be designed to last as long as required to allow for a smooth transition from the Legacy system to Nude solutions.

There are Pros and Cons to a "big bang" conversion versus a longer term one line-of-business at a time migration. If the one line-of-business at a time migration option is chosen, then co-existence requires several integration points between the Products on the new system versus those still on the Legacy system. A co-existence strategy can be designed to last as long as required to allow for a smooth transition from the Legacy system to Nude solutions.

Conversion

Conversion from a Legacy system to Nude solutions involves several Systems. The conversion could include:

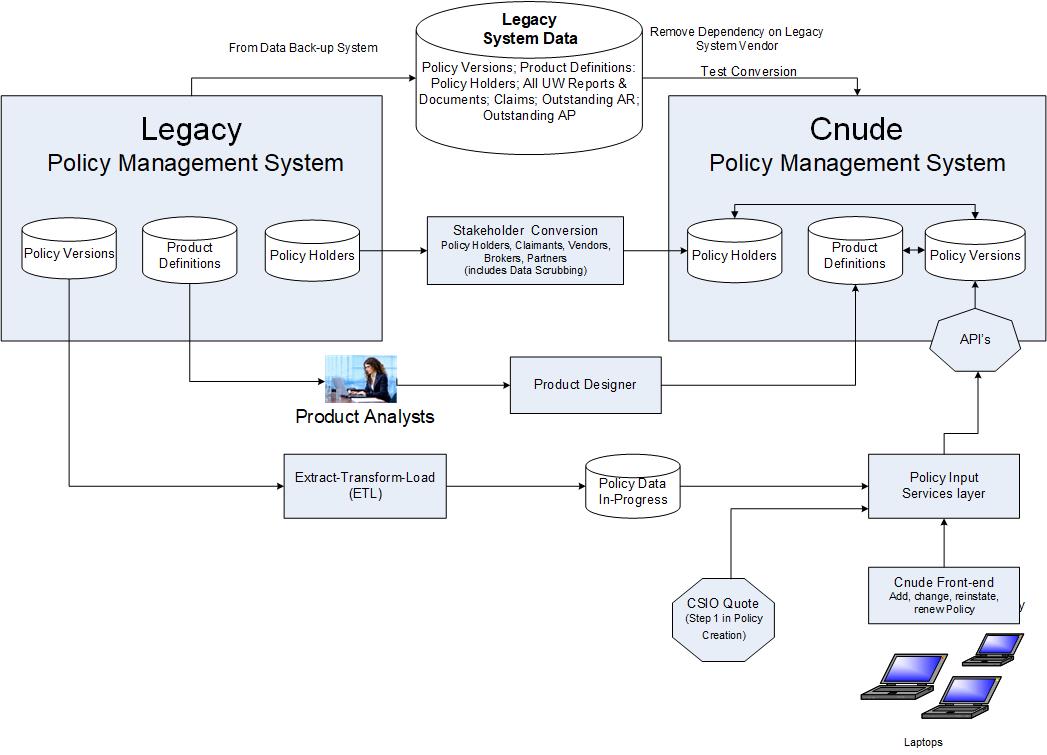

The most complex of the conversions involves the Policy Management and Product Management Systems. An overview of how this conversion can work is as follows:

- The Policy Management System;

- Include Product Management (Product Designer)

- Customized Lines-of-Business including but not limited to:

- Home; Tenant; Condo; Farm; Auto

- Commercial; Commercial Farm; Commercial Auto;

- Liability

- the Claims and Reserve Management System;

- the Financial Systems including the GL Chart-of-Accounts; Outstanding Accounts Receivable and outstanding Accounts Payable; Preauthorized Bank deposits or withdrawals;

- document Conversion and

- the conversion of all Stakeholders (Policy Holders; Claimants; Vendors; Brokers; Suppliers).

The most complex of the conversions involves the Policy Management and Product Management Systems. An overview of how this conversion can work is as follows:

Policy Management Systems Conversion

Claims and Reserve Management Conversion

Claim conversion follows Policy conversion. To create a Claim, or to convert a Claim requires an interface to the Policy to determine coverages on the Policy and Claimant (Policy Holder) details. It is necessary to convert open Claims or any Claim that "becomes active" even if the Policy has expired.

Setting Reserves is a fundamental part of Financial reporting so a conversion of the outstanding Reserve amounts at the time of conversion is essential. Open Claims will have outstanding Reserve amounts, these reserve amounts need to be carried forward to the new system.

Setting Reserves is a fundamental part of Financial reporting so a conversion of the outstanding Reserve amounts at the time of conversion is essential. Open Claims will have outstanding Reserve amounts, these reserve amounts need to be carried forward to the new system.

Financial Systems Conversion

Financial Conversion has several components. These are summarized below:

General Ledger - Chart-of-Accounts

If you are not changing your General Ledger system then this conversion does not apply. Conversion of systems may be the opportunity to clean-up the Chart-of-Accounts to align with the Product Lines you define within the new system.

Outstanding Accounts Receivable

As most Policies are paid monthly with a total outstanding Receivable being for one year the outstanding AR is a critical component of conversion. It is also a good cross check that all Policies were converted and accounted for.

Outstanding Accounts Payable

Avoiding this conversion is an option by paying off all outstanding Payables on the day before conversion starts.

Pre-authorized Payment Schedules

Many Customer prefer to pay monthly with automatic withdrawals from their Bank Account. A good conversion should not involve disruption to the end customer so Payment Schedule conversion is highly recommended.

If you are not changing your General Ledger system then this conversion does not apply. Conversion of systems may be the opportunity to clean-up the Chart-of-Accounts to align with the Product Lines you define within the new system.

Outstanding Accounts Receivable

As most Policies are paid monthly with a total outstanding Receivable being for one year the outstanding AR is a critical component of conversion. It is also a good cross check that all Policies were converted and accounted for.

Outstanding Accounts Payable

Avoiding this conversion is an option by paying off all outstanding Payables on the day before conversion starts.

Pre-authorized Payment Schedules

Many Customer prefer to pay monthly with automatic withdrawals from their Bank Account. A good conversion should not involve disruption to the end customer so Payment Schedule conversion is highly recommended.